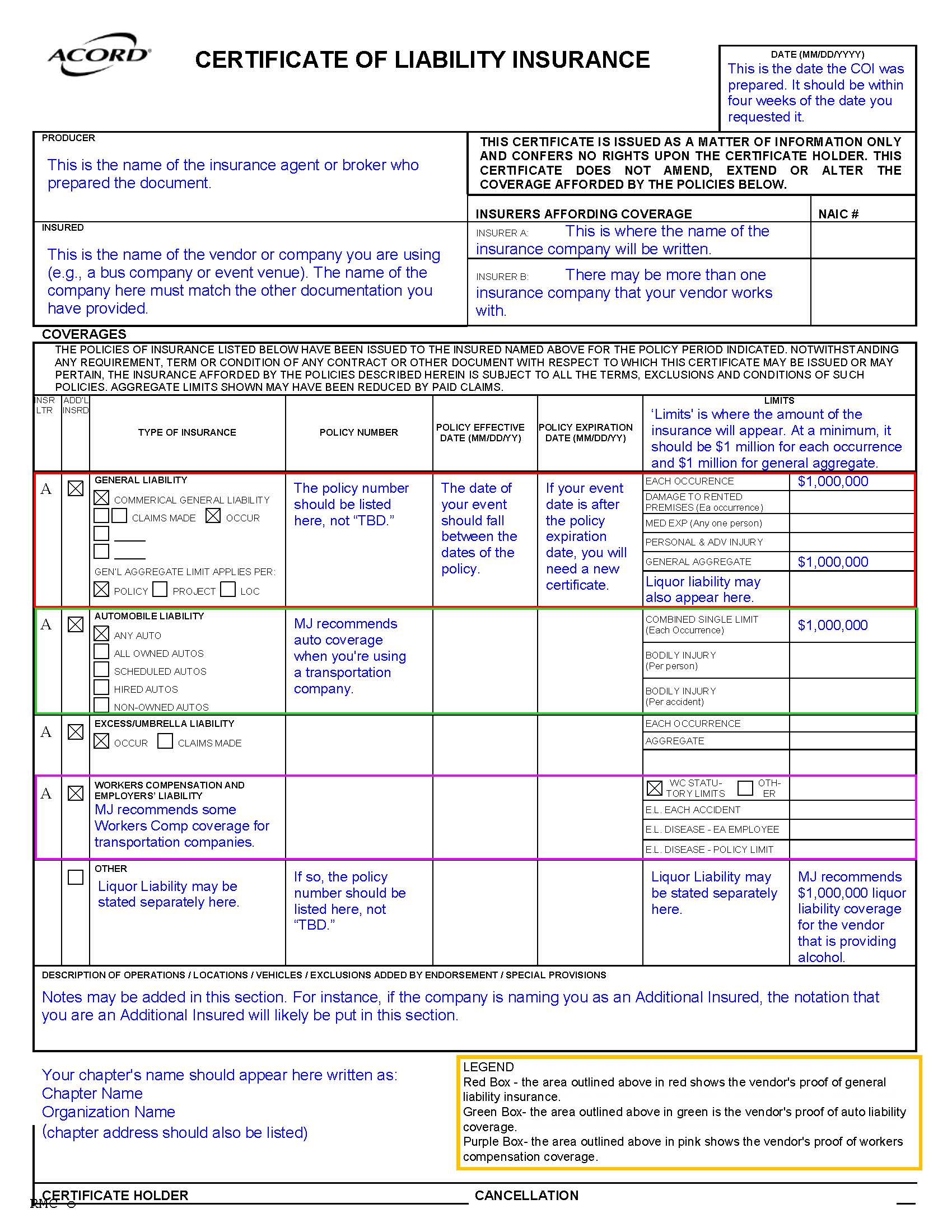

When a venue, vendor, or other third party provides your chapter with a Certificate of Insurance, it can be tough to know what you’re really looking at. To make it easier, we’ve created a sample certificate with MJ’s recommended wording and limits highlighted. Use this guide as a quick reference to spot what’s missing or out of place, so you can feel confident that the coverage being provided truly protects your chapter.

When you’re hosting an event at a venue or other third-party location, your organization’s guidelines require that you obtain proof of insurance from that venue. This is done through a certificate of insurance. A certificate of insurance (COI) is a document that shows a business has insurance coverage. The venue may very well also request to see your organization’s COI, which you can request here (remember you need to have a written request from the venue, often found in your contract!). And be sure to obtain a venue’s COI before signing a contract with the venue for your event.

A certificate of insurance is an official document that summarizes an organization’s insurance coverage. It is the only acceptable form of this confirmation and is part of your due diligence in vetting the venue for an event. Sometimes venues offer declarations sheets or other parts of their policy as proof of insurance. This is not the same as a certificate and should not be accepted.

So you’ve gotten a venue’s certificate of insurance—now what? Certificates of insurance include a wide variety of information, some of which is important, and some of which isn’t relevant to your review. When you receive a certificate, the following are items you should absolutely look for:

Who is the named insured? The named insured should be the name of the vendor. Sometimes this may be a different name “doing business as” the “name of the venue”. For example, if you’re hosting an event at ABC Event Center, the venue’s COI may have the named insured listed as “XYZ Corporation, doing business as ABC Event Center”.

What are the policy limits? MJ recommends that third parties hold the following minimum limits of liability insurance:

| General Liability ($1,000,000 per occurrence) | Liquor Liability ($1,000000 per occurrence) | Automobile Liability ($1,000,000 per occurrence) | Workers’ Compensation ($500,000 per accident) |

| Any third party contractor should hold this amount of general liability coverage | This is recommended if the third party vendor is serving alcohol at a chapter event | This is recommended for third parties providing transportation, such as a bus company | We recommend this coverage for any contractors you engage with |

If a third-party does not hold these minimum limits, please contact your headquarters to determine whether you need to identify an alternative option. There may be some exceptions and differentiations in your organization’s event guidelines.

Liquor liability in particular can be tricky as sometimes it’s listed separately and sometimes is included in the general liability coverage. If it’s included under the general liability section, liquor liability coverage will be noted specifically and you should be able to easily deduce that there is adequate coverage.

What are the policy effective dates? The effective dates are typically one year in length and should cover the date(s) of your event. If the policy is for a short period of time or do not cover the date(s) of your event, the certificate does not provide proof of coverage for your event and you should reach back out to the venue to get clarification and another certificate that provides proof of adequate coverage for your event.

Is your organization listed as a certificate holder? Being a certificate holder means you’re receiving a (COI) to verify that the policyholder has adequate insurance coverage. You are not covered by the policy and don’t have any rights under it. While this may not be required by your organization, it confirms that you have received an up-to-date policy pulled specifically at your request.

Most certificates are relatively straightforward, however, there are some things to look out for that may be problematic:

- Be sure text hasn’t been superimposed on an existing certificate. This is fraudulent and should not be accepted.

- Be sure that the certificate is complete and matches the information in your contract with the venue (i.e. address, name, etc.)

- DO NOT accept COIs that list effective dates as covering one day or a very short period of time. These policies are not acceptable and will not provide adequate coverage in the event of a claim and typically exclude sororities. If you have questions about a policy term, please contact your headquarters

Obtaining a COI is a vital risk management practice when planning events and is a lifelong skill! When hiring a contractor to work on your home or hosting a wedding or baby shower for a friend, you will again run into certificate review.

Click here for a sample COI with our recommendations.

Introduction

Partnering with other student organizations to co-host social or philanthropic events is a common and valued part of campus life. However, these co-sponsored events increase your chapter’s liability—and potentially that of your national organization—beyond what you’d face by simply attending an event as a guest.

As a co-sponsor of an event, your chapter’s liability, or duty of care, is elevated. Because of this elevated liability, it is crucial you engage in good risk management to ensure your event is safe for attendees. This responsibility should not be delegated to the other co-sponsoring organization and you must be an active participant in this important part of hosting an event.

Managing Risk as a Co-Sponsor

Good risk management starts at the beginning of the event planning process. If you are not going to be part of planning the event, you should never agree to co-sponsor. Don’t bring this increased liability to your chapter if you are not going to have an influence on the event and its focus on being safe. There have been cases where chapters were held liable for injuries at events they didn’t help organize, simply because they agreed to co-sponsor. These have resulted in serious and expensive legal claims—a reminder that putting your chapter’s name on an event carries real responsibility.

Before agreeing to co-sponsor, make sure the partnering organization is adequately insured. Just as you would require proof of insurance from a venue, the same should apply to your co-sponsor. If the other organization lacks adequate coverage at acceptable limits of liability, your chapter could be left to shoulder most of the financial burden in the event of a claim.

Where a co-sponsor or third party, such as a venue, is not insured or inadequately insured, it will likely fall on the sorority to cover most of the costs of the claim(s). In the history of the sorority insurance program, we have had several situations where a co-sponsoring organization, such as a men’s fraternity, did not have sufficient limits, and the sorority policy was forced to pay more for the claim than their negligence equated to in the incident.

Spotlight on Co-Sponsoring Events with Men’s Fraternities

In many cases, the other co-sponsor is a men’s fraternity and the co-sponsored event is held on the men’s fraternity’s property. As owners of the property, they are in a much better position to control potentially risky exposures, such as egress from a building, proper lighting of the exterior, etc. Liability follows control and as the owner of the property their liability should be greater than that of a guest to the property, like the co-sponsoring sorority. All the more reason why the men’s fraternity should have sufficient limits of insurance.

Conclusion

Co-sponsored events can be successful and safe, but only when all parties take risk management seriously and are properly insured. If those conditions aren’t met, the event should not move forward.

Ensuring safe transportation for chapter events is a key part of responsible event planning. Whether you’re hiring a bus company or coordinating your own transportation, these best practices can help keep members and guests safe.

1. Verify Vendor Insurance

If hiring a transportation company, confirm that they have at least $1,000,000 in automobile liability coverage per occurrence. This ensures they meet the necessary insurance requirements for safe and reliable service.

2. Consider Adding Security

For events where alcohol is served, security personnel on buses or other transportation can help maintain order and ensure a safer ride for all attendees.

3. Require Use of Provided Transportation

To minimize liability risks and ensure safe travel, attendees should be required to use the provided transportation both to and from the event. This creates a clear start and end to your event and helps ensure everyone gets back safely.

4. Implement Check-In and Check-Out Procedures

Follow your organization’s policies for checking attendees in and out. If transportation is being provided, MJ recommends:

- Check-in before boarding transportation to confirm attendance.

- Check-out upon return to ensure all attendees arrive back safely.

- Consider a “sober hour” before boarding to help ensure members and guests are fit to travel.

5. Follow Your Organization’s Transportation Policies

Every sorority has its own guidelines—be sure to follow your national organization’s transportation policies to stay compliant and reduce risks.

By planning ahead and implementing these best practices, you can help make transportation a smooth, safe part of your chapter’s events.

Don’t hesitate to reach out to your Client Executive with any questions or concerns about event transportation.

This visual guide empowers chapter members to see the big picture, ensuring every detail is covered from start to finish. Simplify your planning process and make your next event a success!

A visual aid to help you determine how to plan safer events. Print-friendly version here.

A quick, self-guided presentation to help you plan your next chapter event.

All About Waivers: Attorney and Client Executive, Estacia Brandenburg, joins us to discuss all that you need to know about liability waivers and sorority events. Sara and Estacia discuss the basics of liability waivers, our position on waivers, and several of your most frequently asked questions.

Event Planning: Special Event Policies – This episode contains a discussion with Ruth and Allison about special event policies as part of our ongoing series on event planning. They dive into what they are, when you need them, what to look for, and more.