Reviewing Certificates of Insurance

When you’re hosting an event at a venue or other third-party location, your organization’s guidelines require that you obtain proof of insurance from that venue. This is done through a certificate of insurance. A certificate of insurance (COI) is a document that shows a business has insurance coverage. The venue may very well also request to see your organization’s COI, which you can request here (remember you need to have a written request from the venue, often found in your contract!). And be sure to obtain a venue’s COI before signing a contract with the venue for your event.

A certificate of insurance is an official document that summarizes an organization’s insurance coverage. It is the only acceptable form of this confirmation and is part of your due diligence in vetting the venue for an event. Sometimes venues offer declarations sheets or other parts of their policy as proof of insurance. This is not the same as a certificate and should not be accepted.

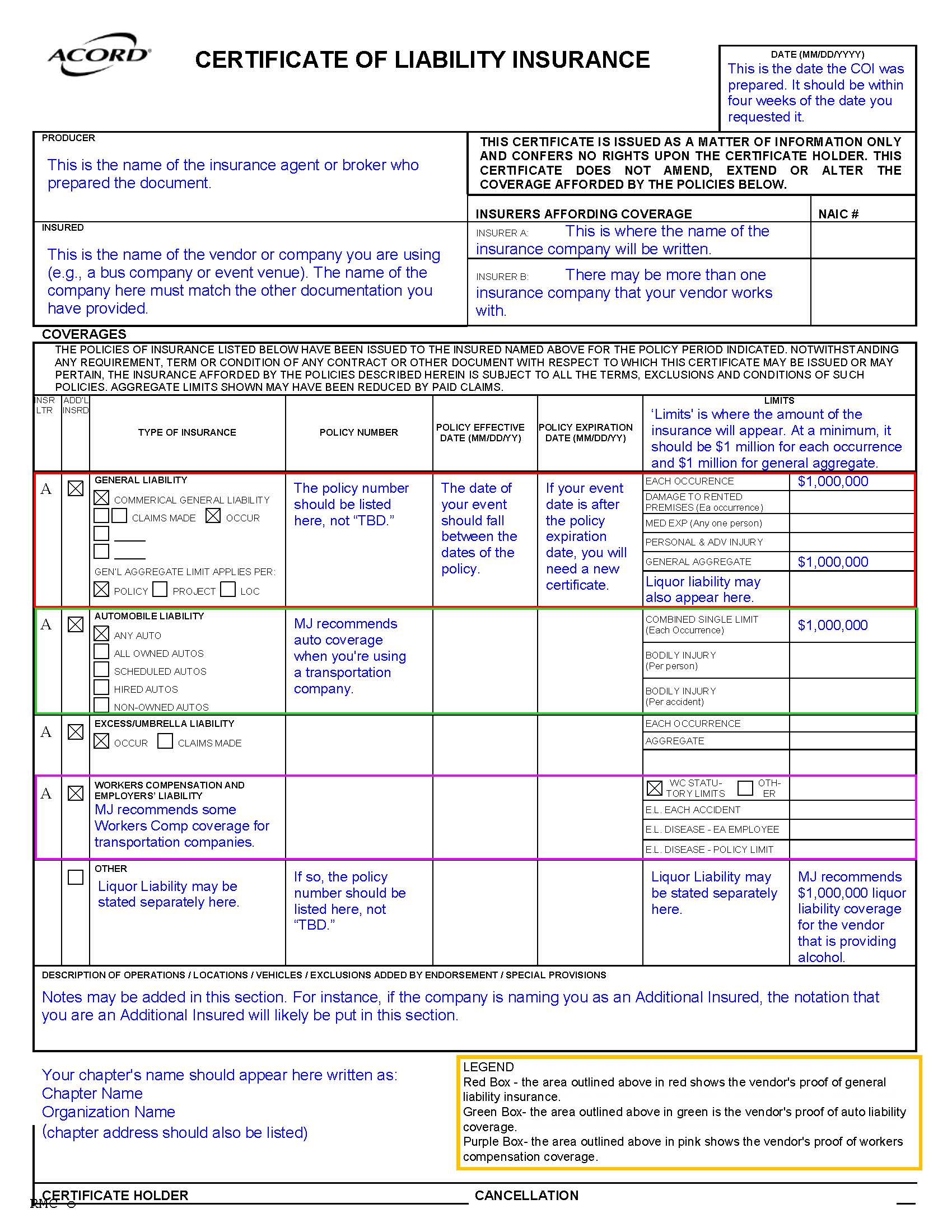

So you’ve gotten a venue’s certificate of insurance—now what? Certificates of insurance include a wide variety of information, some of which is important, and some of which isn’t relevant to your review. When you receive a certificate, the following are items you should absolutely look for:

Who is the named insured? The named insured should be the name of the vendor. Sometimes this may be a different name “doing business as” the “name of the venue”. For example, if you’re hosting an event at ABC Event Center, the venue’s COI may have the named insured listed as “XYZ Corporation, doing business as ABC Event Center”.

What are the policy limits? MJ recommends that third parties hold the following minimum limits of liability insurance:

| General Liability ($1,000,000 per occurrence) | Liquor Liability ($1,000000 per occurrence) | Automobile Liability ($1,000,000 per occurrence) | Workers’ Compensation ($500,000 per accident) |

| Any third party contractor should hold this amount of general liability coverage | This is recommended if the third party vendor is serving alcohol at a chapter event | This is recommended for third parties providing transportation, such as a bus company | We recommend this coverage for any contractors you engage with |

If a third-party does not hold these minimum limits, please contact your headquarters to determine whether you need to identify an alternative option. There may be some exceptions and differentiations in your organization’s event guidelines.

Liquor liability in particular can be tricky as sometimes it’s listed separately and sometimes is included in the general liability coverage. If it’s included under the general liability section, liquor liability coverage will be noted specifically and you should be able to easily deduce that there is adequate coverage.

What are the policy effective dates? The effective dates are typically one year in length and should cover the date(s) of your event. If the policy is for a short period of time or do not cover the date(s) of your event, the certificate does not provide proof of coverage for your event and you should reach back out to the venue to get clarification and another certificate that provides proof of adequate coverage for your event.

Is your organization listed as a certificate holder? Being a certificate holder means you’re receiving a (COI) to verify that the policyholder has adequate insurance coverage. You are not covered by the policy and don’t have any rights under it. While this may not be required by your organization, it confirms that you have received an up-to-date policy pulled specifically at your request.

Most certificates are relatively straightforward, however, there are some things to look out for that may be problematic:

- Be sure text hasn’t been superimposed on an existing certificate. This is fraudulent and should not be accepted.

- Be sure that the certificate is complete and matches the information in your contract with the venue (i.e. address, name, etc.)

- DO NOT accept COIs that list effective dates as covering one day or a very short period of time. These policies are not acceptable and will not provide adequate coverage in the event of a claim and typically exclude sororities. If you have questions about a policy term, please contact your headquarters

Obtaining a COI is a vital risk management practice when planning events and is a lifelong skill! When hiring a contractor to work on your home or hosting a wedding or baby shower for a friend, you will again run into certificate review.

Click here for a sample COI with our recommendations.