All About Waivers: Attorney and Client Executive, Estacia Brandenburg, joins us to discuss all that you need to know about liability waivers and sorority events. Sara and Estacia discuss the basics of liability waivers, our position on waivers, and several of your most frequently asked questions.

January 2022: Topics include winter weather reminders, Covid-19 updates, accounting best practices, renting your chapter house for events, and insurance limits.

The milder days of spring are a perfect time to do a thorough spring cleaning and perform routine maintenance. After a long winter, it is a good idea to spend time on preventive measures to help maintain your property throughout the year. Tasks such as cleaning out your gutters, checking for dead trees and branches and cleaning and inspecting facility mechanical and plumbing systems, such as heating and air conditioning equipment, can help make spring a season of safety.

Cleaning and maintenance of your chapter house should be done inside and out. Although the tasks are different, checking to see if all the elements of your property are in good working order can help keep your members and employees safe and your maintenance expenses lower over the long run.

Inside the Chapter House

Here are a few things inside your facility that should be inspected to determine if they are in good condition:

- Electrical Outlets and Cords: Check electrical outlets and cords throughout your property for any potential fire hazards such as frayed wires or loose-fitting plugs. Extension cords and power strips are not designed to be permanent fixtures and should only be used on an interim basis.

- Fire Extinguishers: Check your fire extinguishers at least once yearly, including the hose, nozzle and other parts to determine if they are in good condition and that the pressure gauge is in the “green” range. Check the expiration date.

- Air Conditioning: Check around the unit for indications of leaks. Before turning it on for the season, have your air-conditioning system inspected and tuned up by a professional. Check the drain lines annually and clean them if they are clogged. Change the air filter.

- Water Heater: Check for leaks and corrosion. Check your owner’s manual for any recommended maintenance.

- Furnace or Boiler: Have your furnace or boiler cleaned or inspected annually.

- Under Sinks and Around Toilets: Look for any signs of leaks or corrosion on pipes, supply lines and fixtures.

- Plumbing: Check exposed pipes and valves in your basement or crawl spaces, if safely accessible, for signs of leaking or corrosion.

- Appliances: Check supply lines for washing machines, ice makers and water dispensers, refrigerators, and dishwashers for signs of leaks or wear and tear.

- Plumbing for Hose Spigots and Irrigation Systems: After opening valves for outdoor water supplies, be sure to inspect components for leaks. Don’t forget to check inside plumbing as well as outdoor spigots.

- Dryers: Dryer lint can build up inside the vent pipe and collect around the duct. Clean both the clothes dryer exhaust duct and the space under the dryer. Use a brush to clean out the vent pipe. Look for lint buildup around the lint trap and clean it as needed.

- Smoke Detectors: Daylight savings time is a good time to change the batteries in your smoke detectors. Inspect each smoke detector to determine if all are in working order, and make sure to test them monthly.

- Light bulbs: Check each light bulb in every fixture for the correct recommended wattage and replace any burned out bulbs.

Outside the Chapter House

The cold winter months can do damage to your property as well. Here are a few things outside your facility that should be inspected to ensure they are in good condition:

- Roof: Check for any damage from snow or ice, and make any necessary repairs to reduce the possibility of leaks. If you have a skylight, check outside for a buildup of leaves and debris. Also, check the indoor ceiling for signs of leaks. Remember to put safety first any time you are on a roof. If you have any doubt, leave it to the professionals.

- Gutters: Clean leaves and other debris from gutters and downspouts to keep water flowing and reduce the possibility of water damage.

- Trees: Visually inspect trees for damage or rot, and remove (consider hiring a licensed professional) any dead trees that might blow over in heavy winds or during a storm. Keep healthy trees and bushes trimmed and away from utility wires.

- Lawn Equipment: Make sure lawn mowers, tractors and other equipment are tuned up before using. Store oil and gas for lawn equipment and tools in a vented, locked area.

- Walkways and Driveways: Repair any cracks and broken or uneven surfaces to provide a safer, level walking area.

A little home maintenance in the spring can go a long way to help keep the chapter house safe and secure throughout the rest of the year.

Event Planning: Special Event Policies – This episode contains a discussion with Ruth and Allison about special event policies as part of our ongoing series on event planning. They dive into what they are, when you need them, what to look for, and more.

Unofficial Houses: What, Why, & How – In this episode, Allison and Sara discuss what we call “unofficial houses.”

October 2021: Topics include Leak Protection, water damage, COVID-19, & wellness rules overview.

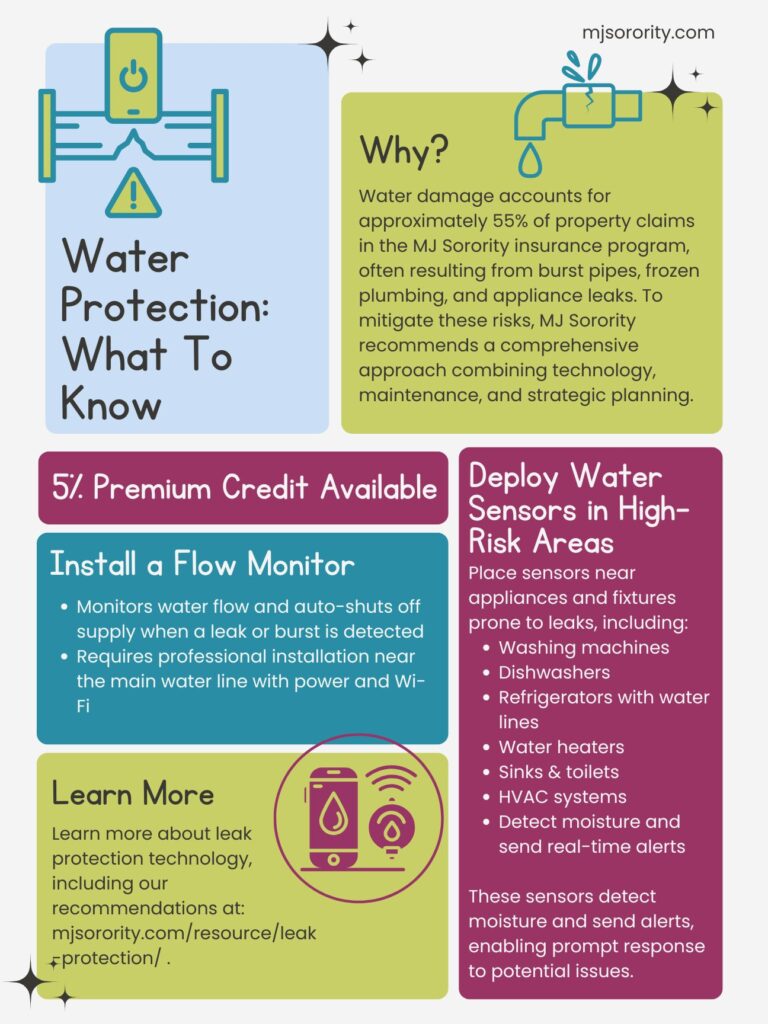

Water damage is the leading cause of property claims in the MJ Sorority insurance program, accounting for 55% of all reported claims. From frozen or burst pipes to leaking appliances and sewer backups, water can be one of the most disruptive and expensive property issues. Even with comprehensive insurance coverage, things like the disruption of member experience and the increased time and attention required of your volunteers will be inevitable consequences.

The best defense is a proactive one. That’s why we strongly encourage property managers and house corporations to take preventative steps by installing a comprehensive water protection system. These systems are not only an effective way to avoid costly damage but installing leak detection could also make your property eligible for a 5% credit at renewal, applied to your property insurance premium. Contact your Client Executive for more information.

What Can a Water Protection System Include?

A comprehensive water protection setup typically involves three components: (1) smart water sensors; (2) a flow monitoring system; and (3) freeze sensors. Find below an overview of each:

1. Smart Water Sensors

These devices serve as the frontline defense against water damage by detecting moisture and leaks throughout the property. Strategically placed sensors can promptly alert housing corporations and property managers via mobile notifications upon detecting any signs of leakage.

Recommended sensor locations:

- Washing machines

- Dishwashers

- Refrigerators with ice makers and water dispensers

- Hot water heaters

- Sinks

- Toilets

- Around exposed pipes

- Furnaces connected to water systems, including hot air system humidifiers

It may take some experimentation to determine where these should be placed to detect the unusual presence of water. It is imperative to work with a house director who is familiar with the usual patterns of water usage and presence, as well as the history of a property’s water damage or usual problem areas. Should you have any doubt about your location’s water loss experience, contact your Client Executive for a loss run.

2. Flow Monitoring System

Installed by a plumber on the main water line, this device monitors water flow throughout the property. It identifies abnormal usage patterns that may indicate hidden leaks and can be integrated with your plumbing system to provide real time alerts.

If this flow monitor detects any unusual pattern in water use, it will automatically shut off the flow of water to the property. These devices also allow the user to customize the threshold for water flow before an alert is issued based on the time of year and even the time of day, helping you manage usual vs. unusual water use. These devices also offer companion apps and/or text and email alerts to keep your property management and house corporation officials informed in real time, which can be especially helpful when the house is unoccupied for school breaks.

Importantly, flow monitors can detect leaks in places where water sensors cannot such as behind walls or under the foundation, offering an added layer of protection.

3. Freeze Sensors:

In times of arctic freeze, 45% of claims are due to the sprinkler pipes freezing and upon thawing, significant amount of water are released to the property. These sensors monitor water temperature in your pipes and alert you if the temperature drops low enough to risk freezing pipes (typically around 45°F or 7°C). You may consider these sensors for both sprinkler and domestic pipes. Use of these sensors is risk dependent and you should consider your location when determining the necessity of a freeze sensor.

MJ Sorority Recommendations and Premium Credit Requirements

Currently your property deductible for water damage is your standard property deductible. Because water damage claims continue to be so pervasive for the insurance industry, many insurance companies are now separating out the water hazard claims and affixing a much higher deductible. Using a risk management tool like a water protection system will help your property maintain a lower deductible.

At minimum, installing smart leak detection water sensors that notify you of visible leaks can help prevent major water damage when issues are caught early. We recommend placing these sensors in locations where water presence would be unusual yet possible (see list above).

Flow monitoring systems provide a deeper level of protection, identifying hidden leaks in domestic water pipes before they become visible. A small, undetected leak behind a wall can lead to extensive damage. While these systems are highly recommended, we understand the automatic shutoff function may cause inconveniences, such as when higher-than-usual water use occurs before weekend events. For this reason, a flow monitoring system is not required to receive the 5% premium credit, though it remains best practice.

Chapters in colder climates should also seriously consider installing freeze sensors. At a minimum, we recommend temperature sensors that monitor overall house temperature as an indication of pipe conditions. For added protection, technologies that monitor temperature within sprinkler systems are available and particularly important for chapters with a history of frozen pipe issues.

Leak Detection Systems Are Worth the Investment

- Estimated cost: $2,500–$4,000 per chapter house

- Installation: Depending on the technology you use, installation can be completed by a property manager or handyman, but may require a plumber if installing flow monitoring or other technology that integrated directly into your domestic or sprinkler piping.

- Requirements: You’ll need to know the size of your water main pipe to select the appropriate flow monitoring device. Your plumber or property management partner can help with this.

Business Partner Suggestions

We suggest exploring the following business partners for water protection products:

- Alert Labs (20% discount available through Travelers)

- Flo by Moen

- FloLogic

- Johnson Controls

- LeakDefense

- Monnit (20% discount available through Travelers)

- Phyn Plus

- Salamander (for sprinkler pipe freeze detection)

- Sentinel Leak Defense

- YoLink

Initial Protective Steps

Although the options above are the best way to reduce your risk of water damage, use these basic tips as supplements, but not substitutes, for water detection devices.

- Check your water heater for leaks annually. 75% fail before they’re 12 years old.

- Replace your appliance hoses every 5 years. Steel-braided hoses are best.

- If you have a sump pump, test it once a year. Consider a battery backup, too.

- Watch your water bill. If it’s higher than normal, you could have a small leak.

- Find your main water valve. That way you can turn it off quickly in an emergency.

Take Action Now

Don’t wait for a claim to find out how vulnerable your property is to water damage. Investing in water protection technology now will protect your chapter house, reduce your risk, and earn you a property insurance premium credit at renewal.

For further reading on preventing water damage, refer to our printable infographic or this resource for additional tips. For further information on water damage claims for the MJ Sorority book of business, refer to this infographic.

Understanding the risks

In the event of flooding or a higher-than-normal water table due to heavy rains, sewage could back up through floor drains or plumbing fixtures located in a basement or lower level. When rising storm waters are expected, it is vitally important to establish a watch system to monitor your property drainage system to quickly identify and address any issues such as back-up, flooding, etc. Being prepared and responding quickly often minimizes the damage potential. The following are some methods to help minimize sewer backup into a building.

Floor drains

If sewage starts to back up into a home or business from the floor drains, it is possible to plug these drains. Floor drains are often at the lowest point in your facility and, as a result, may be the first entry point for sewage backup. Rubber or wooden plugs, purchased at many hardware stores, may be used to close off drains during heavy rains. If plugs are used, mark them prominently if they protrude beyond the floor level so they don’t become a tripping hazard.

Toilets, shower/bath drains and other fixtures

After plugging floor drains, if the sewer water level becomes high enough, it may fill and overflow other plumbing fixtures located in the basement or lower level. Plug these drain openings with stoppers or plugs. A string mop can be used to help plug toilet openings. Be aware that ceramic plumbing fixtures such as toilets may be fragile.

Important note:

Plugging of drains or fixtures should only be done where the condition of the sewer piping below the floor is considered to be strong and tight. Otherwise, heavy rainstorms or flooding may cause a build-up of water pressure within the house or business’ sewer system great enough to rupture pipe joints or damage basement floors.

Backwater prevention valves

Some properties may have backwater valves installed on sewer lines. Some are manually closed gate valves, while others are automatic check valves.

- Manual valves – You can isolate your system from the sewer system by closing manual valves at the first sign of backup during heavy rains and flooding, or if you plan to leave the building

- Automatic valves – Automatic check valves require periodic maintenance to ensure that they will operate properly when needed. If there hasn’t been a recent inspection and maintenance, this valve should be inspected and maintained as soon as possible if heavy rains or flooding are a possibility in the area

Remember that while the valve is closed and protecting your home or business from sewage backup, normal sewage flow from the building to the sanitary sewer is also cut off. This means that plumbing fixtures cannot be used unless a pump bypass is provided.

Local advice

Many towns also have a comprehensive website with information and advice regarding prevention techniques. You should also refer to your local municipality for assistance.

Leak detection

Leak detection devices are a great way to prevent a sewer backup from doing more significant damage. Click here for further reading.

As everyone over the age of twelve is now eligible for vaccines, more questions arise for employers. MJ has developed a resource full of frequently asked questions about the Covid vaccines. In addition, be sure to check out the Fisher Phillips vaccine resource center for employers, including their sample vaccination mandate template.

The EEOC COVID-19 website will provide some initial questions and answers to those areas of risk for your organization as an employer. As a private business, from a legal perspective, there is little preventing you from imposing a vaccination requirement on your employees. You will need to balance that against operational risks associated with a mandatory program. Generally, an employer can implement a mandatory vaccination program. This ability by the employer, however, is subject to reasonable accommodation obligations under federal, state, and local laws for those with disabilities who request a medical accommodation or those who have a religious belief against vaccinations. You do have greater latitude to consider when managing this exposure, but there still remains some regulatory and legislative boundaries that you need to review whether it be EEOC and/or OSHA on this subject. The two notable exceptions to this mandate are when an employee can attest to having a medical condition that could cause a real danger of serious illness or death in the event of inoculation and when the employee maintains privately held religious beliefs that are inconsistent with taking vaccines.

Setting aside the question of legality, each business will carefully need to consider all aspects of this matter and calculate all of the inherent risks. Now that vaccines are widely available for everyone over the age of twelve and with the full FDA approval of the Pfizer vaccine, it makes it easier for employers to require vaccination. That being said, each employer must do what it believes is best for its operation. As a sorority headquarters and also sorority chapter house operations, you need to consider not only the health and safety of the employees operating on your property, but also the resident collegiate members. Both the EEOC and the Center for Disease Control have acknowledged the inherent risk of having a COVID-19 infected person in the workplace posing a significant risk of substantial harm to others.

Employers should begin to evaluate their specific workplace situation and determine what is the correct course of action for them by considering the following:

- Employers should ask if a mandatory vaccination program is necessary to their industry, workforce or workplace facilities such as chapter houses?

- If the employer deems a mandatory vaccination program necessary, is it organization-wide or are there restrictions based on being a remote worker, exposure to chapter members across the country, etc.?

- If a mandatory program is implemented, employers should evaluate their accommodation (exception) processes to be able to quickly react to all requests that may arise by employees.

Whatever the case may be, it is recommended that, as an employer, you provide proper education relating to Covid-19 protocol, vaccinations, in general, and the rights of employees to refuse a vaccine. All the while, continuing to practice safe exposure control to prevent the spread of the virus, remove barriers which might pressure reporting to work when sick and make it easy for employees to receive inoculations to fend off COVID-19, even if not mandated.

Employees should have one individual or department who is responsible and accountable for compliance around a mandatory vaccine program and its processes. This is especially critical if the employment at the chapter houses is managed locally. This is a complex issue to effectively navigate and the local management may not be as familiar with all of the inherent risks of this matter.

Given the fast-evolving nature of the question, it is crucial for employers to monitor new laws and guidance from federal and state authorities. Employers should weigh the legal exposure and other risks associated with any mandatory vaccination program, and assess whether the alternative of voluntary vaccination may be a better option based on the nature and needs of your business.

We have seen a dramatic increase in claims arising out of frozen pipes over the last two years. Frozen pipes can present an invisible threat – one that you might not recognize until the weather starts to warm. By then, the water damage can be significant and costly. Fortunately, keeping your home warmer, at a consistent temperature, and better insulated can help protect your pipes from freezing this winter.

Which Pipes Are Most at Risk?

Pipes that are most exposed to the elements, including those outdoors and along the exterior walls of your home, likely need extra protection during winter months. These include the following:

- Outdoor hose hookups and faucets.

- Swimming pool supply lines.

- Lawn sprinkler lines.

- Water pipes in unheated, interior locations such as basements, crawl spaces, attics, garages and kitchen and bathroom cabinets.

- Pipes running against exterior walls with little or no insulation.

Before winter:

- Check your home for areas where water pipes are located in unheated or poorly insulated areas. Be sure to check your basement, attic, crawl space, garage and within cabinets containing plumbing. Hot and cold water pipes should both be insulated.

- Products such as pipe sleeves or UL-listed heat tape or heat cable can help insulate or heat exposed water pipes.

During winter:

- Close inside valves supplying water to outdoor faucets and hookups.

- Open outdoor faucets to allow residual water to drain; be sure to keep them open during the cold weather months, while the water supply is turned off.

- Keep garage doors closed to help protect water pipes located in the garage.

- Open the doors on cabinets where plumbing is located. This can help allow warmer air to circulate around the pipes.

- For pipes that are at risk of freezing (both hot and cold water pipes), let water drip from faucets.

- Keep the heat in your home set at a minimum of 55 degrees.

Why is a Frozen Pipe a Concern?

When water begins to freeze, it expands. This can cause both plastic and metal pipes to burst, possibly leading to significant water damage to your home.

- Since water expands when it freezes, it puts unwanted pressure on pipes.

- As water freezes, the force exerted from the expansion can cause a pipe to burst, regardless of the strength of the material.

- You may not know you have a burst pipe as the water has turned to ice. Once the temperature starts to warm and thawing begins, leaking and flooding can occur.

What Do You Do if You Have a Frozen Pipe?

- If you have a leak, turn the water off immediately to prevent water damage and call a licensed plumber to make repairs. If your home is heated by an older steam heating system, consult with your heating professional to determine if it is safe to continue to run the heating system with the water supply turned off for your particular heating system.

How to Help Prevent Frozen Pipes

We have created a printable infographic with these reminders for your use.

In addition, make sure you complete MJ’s Winter Weather Checklist prior to the onset of winter weather. More detailed tips to manage the risk of frozen pipes is available here.